Buying Public liability insurance Online made Quick, Easy & Affordable

- Protects your business

- Employee Protection

- Public Safety

Running a salon in Jumeirah, operating a construction site in Abu Dhabi, or managing a food truck outside Expo City all share one hidden risk: an unexpected accident involving a third party. A customer slips on a wet floor, a falling tool damages a parked car, or stray sparks injure a passer-by. In the UAE, where compensation claims can quickly escalate and legal costs mount, public liability insurance acts as a financial safety net that keeps your company’s cash flow—and reputation—intact.

Public liability insurance (often shortened to “PL”) covers your legal liability if a member of the public is injured, falls sick, or suffers property damage because of your business activities. Unlike workers’ compensation, which protects employees, PL focuses on clients, suppliers, visitors, and bystanders.

Key features usually include:

Public liability insurance covers the loss or damage that your business may cause to third-party property.

It provides coverage for your legal liability in cases of personal injury or death of a third party resulting from your business activities.

This insurance handles any compensation you're required to pay as a consequence of a covered claim against your business.

It also covers the legal costs incurred while defending against a covered claim, ensuring your financial protection in legal disputes.

Public liability insurance (PL) is essential for businesses that interact with the public. In the UAE, while not legally mandatory for all sectors, it has become a vital protection for many.

Business Owners Business owners rely on public liability insurance to protect against third-party injury or damage claims, ensuring financial security

Contractors and Tradespeople Contractors and builders rely on it, covering liabilities from work-related accidents, damage, and injuries, along with legal costs.

Event Organizers Event organizers need public liability insurance to cover accidents or damage during events

Complex paper works & Compliance

Hassle Free Claim Insurance

Getting the best Insurance Plans

One of the most searched questions on Google—“how to calculate public liability insurance”—doesn’t have a single answer, but insurers follow similar formulas.

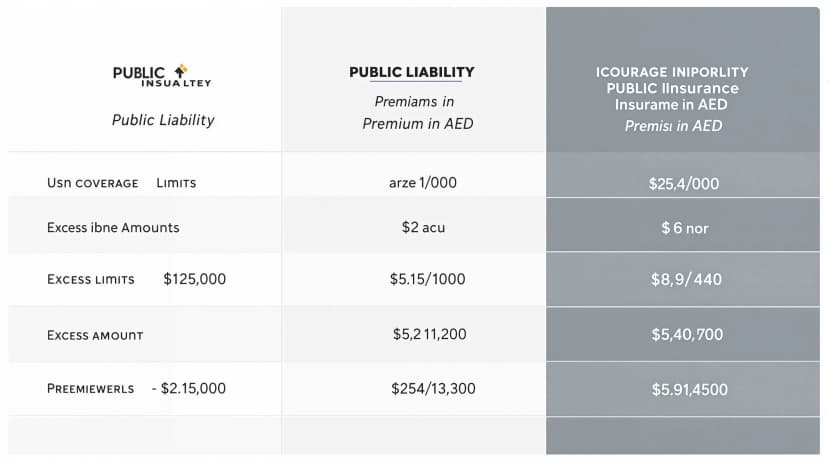

UAE insurers typically charge premiums from AED 750 to AED 5,000 annually for SMEs. High-risk industries or premium limits above AED 10 million can push costs higher

Base rate x (Turnover ÷ 1,000) x Risk loading = Annual premium

For example: 0.3 % base rate × (AED 2,000,000 ÷ 1,000) × 1.2 risk factor ≈ AED 7,200

Public liability insurance covers third-party claims for property damage or bodily injury that occur on your business premises. It helps reduce financial risk and ensures smooth operations

With over 50 insurers licensed by the Central Bank, shopping around is key. Here’s what you should compare before choosing a provider:

While a “cheap public liability insurance” deal is tempting, cutting corners can cost you. Instead, try these strategies:

As a trusted insurance aggregator in the UAE, Insurancehub.ae partners with top providers to offer tailored public liability insurance plans. Their platform offers 24/7 support, instant online service, and affordable coverage options

Mandatory for many industries, this insurance protects businesses from legal and financial liabilities due to negligence or third-party damages. It ensures business continuity and legal compliance

Accidents are unpredictable, but your response shouldn’t be. Get peace of mind in minutes—compare, choose, and purchase your public liability insurance online at InsuranceHub.

Cheapest public liability Insurance Abu dhabi | Cheapest public liability Insurance in Abu dhabi | Best public liability Insurance in Abu dhabi

Public liability Insurance is a necessity for your business.

Talk to our Advisor